You may already know they can help you come tax time, but what are tax deductions and how are they different from tax credits? Tax deductions lower your taxable income. Tax credits provide you with an overall discount on your tax bill. Let’s break down exactly what that means so you can optimize your tax

The post What Are Tax Deductions and Credits? 20 Ways To Save on Taxes appeared first on MintLife Blog.

When it comes to building your wealth and planning for your financial future, investing is one of the best decisions you can make.

The benefits of smart investing are plentiful. When done strategically, investing can allow you to outpace rising inflation and build wealth on your own terms. Additionally, good investments can generate earnings when they’re reinvested, allowing your initial investment to compound over time.

All this is to say that the benefits of investing can be profound, provided you do your homework ahead of time and maintain awareness of your budget and the riskiness of the investment.

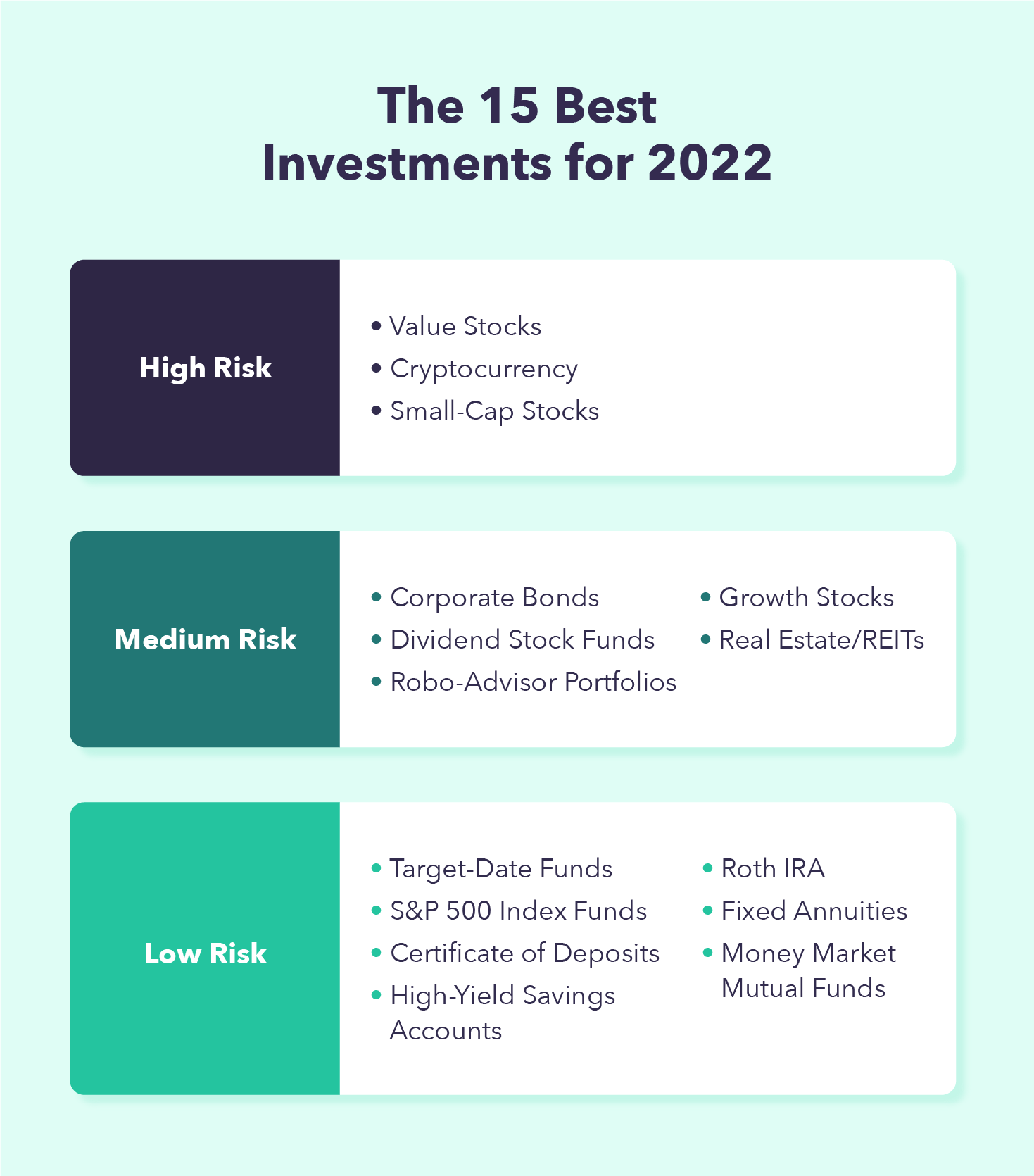

The list below highlights the best investments for 2023, mixing both long and short-term investments as well as the varying levels of risk for each. While other solid investment options exist, these 15 investments take into account rising inflation and interest rates while providing options for both high- and low-risk investors.

1. Value Stocks

Value stocks are stocks that are being traded at a relatively low price as investors sometimes view them as undesirable, which drives their price down.

However, if you’re patient, value stocks could yield significant profit down the road since you can buy them at a bargain price.

Best for: Value stocks are best for higher-risk investors who are willing to commit to a long-term investment.

Risks: Value stocks tend to fluctuate more than bonds and are often riskier than growth stocks. When you invest in value stocks, you’re betting on a company that many investors may view as unfavorable.

Rewards: Value stocks are more affordable than most growth stocks and tend to perform better than growth stocks when interest rates rise.

Where to buy: You can buy value stocks from most online brokers.

2. Cryptocurrency

Cryptocurrency has been one of the hottest investments of the last few years, largely because of the price volatility. Coin prices tend to fluctuate dramatically since they’re influenced by supply and demand as well as media attention.

As a result, investing in crypto has become popular because of its high risks and potentially large payoff from relatively small investments.

Best for: Cryptocurrency is popular with investors with the highest risk tolerance. You can score big on crypto, but the price of the coin can plummet quickly.

Risks: Losing it all. Just as easily as a coin gains significant value in a short spurt, it can lose that value as well.

Rewards: While crypto has been down in 2022, the market has grown exponentially in the past decade. If you’ve held onto your coins for the last three to five years, you’ve likely seen significant gains.

Where to buy: Another benefit of crypto is the ease of transaction and accessibility. You can buy crypto from traditional brokers as well as online crypto exchanges, like Coinbase.

3. Small-Cap Stocks

Small-cap stocks refer to shares of a public company that are valued at around $500 million to $1 billion dollars. Small-cap is the lowest of the three market capitalizations: small, mid, and large. People who invest in small-cap stocks are generally betting on the future success of the company.

A large-cap offering falls north of $10 billion, but these companies usually start from a higher base. Therefore, their growth tends to be a smaller percentage compared to younger companies. For example, a large-cap company may not see 300% growth in one year, but that doesn’t mean they can’t see significant growth. Investing in small-cap stocks generally means you’re investing in younger companies.

Best for: Small-cap stocks appeal to higher-risk investors who don’t mind holding the investment for a long time. If you invest in small-cap stocks, you’re betting on the continued growth of a company.

Risks: Rising inflation and recessions can be troubling for young companies. Young companies can weather the storm and come out healthy on the other side, but they usually have to do it with fewer resources.

Rewards: Small-cap investments generally have the potential for greater growth than large-cap stocks.

Where to buy: You can buy small-cap stocks from online brokers.

4. Corporate Bonds

Corporate bonds are typically issued by successful companies and can oftentimes yield high dividends. In 2022, corporate bond yields are near multi-year highs and tend to be less risky than stocks. When you invest in a corporate bond, you’re essentially betting on a successful company to continue being successful.

Best for: Corporate bonds are a good option for medium-risk investors looking for a less volatile investment option than stocks.

Risks: The price of a bond falls when interest rates rise. Since bonds have fixed interest rates, the value of your bond won’t rise with interest rates and will be worth less as a result.

Rewards: Corporate bonds are less volatile than stocks and may yield more than government bonds.

Where to buy: You can purchase bonds through major brokers like Fidelity and Charles Schwab.

5. Dividend Stock Funds

Dividend stock funds are mutual funds or exchange-traded funds (ETFs) that invest in stocks that pay dividends. These funds allow you to diversify your investments so you’re not relying too heavily on one company.

When buying a dividend fund, you’re anticipating the companies within the fund will continue to profit over time. If you choose carefully, you may get payouts on a quarterly basis.

Best for: Dividend stock funds are appealing because investors can profit through increases to the share price as well as dividends paid by the company. Unlike stocks, dividend stock funds may pay out cash on a quarterly basis — provided the company remains profitable.

Risks: If a company goes into crisis and stops generating profits, you may lose money on your investment since the company has nothing to pay out. You should also note that dividends are never guaranteed and companies will only pay them out when it makes fiscal sense.

Rewards: If the company is generating profits, you may receive cash on a regular basis. If you invest in a company that continues to profit, you’ll profit as well.

Where to buy: You can purchase dividend stock funds through brokerage firms.

6. Robo-Advisor Portfolios

A robo-advisor is an AI-powered tool that tries to maximize returns through algorithmic software.

These advisors use modern portfolio theory to guide their investment strategies. The industry has grown dramatically in the last 10 years due to increased interest from younger investors. The easy 24 hour access to a robo-advisor makes them more appealing to some investors than a human financial advisor.

Best for: Robo-advisors lend themselves to investors looking for an inexpensive and efficient alternative to human financial advisors that they can access 24 hours a day.

Risks: Robo-advisors have been criticized for lacking the human emotion that a financial advisor possesses. If there is a significant market decline, a robo-advisor won’t be able to offer the same comfort and guidance that a human financial advisor could.

Rewards: Robo-advisors are generally low cost and accessible 24 hours a day. Robo-Advisors use notable and impressive investment theories to make decisions, which can make the potential for profit much greater.

Where to buy: Robo-advisors are available through automated investing platforms, including Betterment, Wealthfront, Interactive Advisors, and Stash.

7. Growth Stocks

Growth stocks are shares in companies that are expected to grow at a higher rate than average market growth. A popular investing strategy in bear markets, growth stocks are typically issued by companies that churn their profits back into their business and, as a result, don’t pay out dividends.

Growth stocks are attractive because investors tend to make money through capital gains, meaning you can sell the stock further down the road for more than you paid for it. When investing in growth stocks, you’re investing in the idea that a company is undervalued and will be worth more in the future.

Best for: Growth stocks are good for market-savvy investors who have a solid understanding of market trends and have higher risk tolerance. Choosing the right growth stocks requires knowing which companies are best positioned to profit from the current market.

Risks: Growth stocks generally don’t pay dividends, so the only way to profit is by selling your shares. Therefore, if the company underperforms, you’ll take a loss when you sell.

Rewards: Companies can grow their revenue for an extended period of time. If you hold on to your growth stock long enough, you could be looking at a big payout when you eventually sell.

Where to buy: You can buy growth stocks through any online stock broker, like E*Trade or Robinhood.

8. Real Estate/REITs

Investing in real estate is a long-term investment that requires a larger amount of capital upfront. However, real estate continues to be one of the most attractive investments because of the potential for high returns.

It doesn’t necessarily take an inordinate amount of wealth to invest in real estate. If you’re looking to invest in real estate, you can take out a loan from your bank and pay it off over time.

Real estate investment trusts (REITs) are a way to buy real estate without having to own or manage the property. REITs are companies that own commercial real estate and provide large dividends, making them a good investment if you’re not interested in investing in properties yourself.

Best for: Real estate is best for investors who are committed to a long-term investment and have the time to manage a property. Investing in real estate requires a time commitment; however, you can avoid this by opting for REITs instead.

Risks: If you invest in real estate, it’s difficult to diversify your portfolio. Real estate will likely be your only investment since it’s more costly, so you may not have an investment to fall back on if things don’t go your way. If you borrow money from the bank for your investment, then there’s additional risk. If you opt for REITs instead, there may be more opportunities to diversify your investments.

Rewards: Choosing a good property and managing it well can lead to significant profit. If you hold on to the property long enough, you’re likely to build compounding wealth.

Where to buy: You can purchase shares in REITs through brokerage firms.

9. Target-Date Funds

Target-date funds are retirement funds that allow you to choose a target retirement date, and the fund will allocate your investment based on that date.

Target-date funds take the legwork out of investing. Once you invest, the fund will do the work of balancing risks based on where you are in the cycle.

Best for: Target-date funds are best for people saving for retirement.

Risks: A target-date fund is an investment in the stock market, therefore inflation and down markets can affect your income.

Rewards: Target-date funds diversify your assets for you, meaning you don’t have to manually diversify your portfolio after investing in a target-date fund.

Where to buy: People most commonly invest in target-date funds through company 401k plans.

10. S&P 500 Index Fund

Investing in the S&P 500 means you’re investing in the 500 largest companies by market capitalization. As a result, you may be more likely to profit over the long term.

By investing in the S&P 500, you’re casting a wide net and automatically diversifying your portfolio since you’re putting stake in 500 different companies.

Best for: The S&P 500 is great for beginner investors willing to hold onto a long-term investment. Investing in the S&P 500 doesn’t require a ton of market savviness — you know you’re investing in large, successful companies.

Risks: While the S&P 500 is a less risky investment, it still consists of stocks. Therefore, your investment can be subject to market volatility.

Rewards: The S&P 500 allows you to invest in a diverse set of companies. The index includes companies from a variety of industries.

Where to buy: You can invest in the S&P 500 through any stock broker.

11. Certificates of Deposit (CDs)

CDs involve paying a lump sum that remains untouched for a period of time as it gains interest. CDs are less risky and guarantee profit; the payout just won’t be as significant as growth stocks, for example.

Since CDs are fixed and federally insured, you can avoid market volatility by opting for this investment. As a result, CDs tend to be good option for low-risk investors.

Best for: CDs appeal to low-risk investors looking for a guaranteed return on investment.

Risks: If you access your money before the maturity date, you’ll have to pay a penalty fee.

Rewards: You’ll receive a guaranteed return at maturity.

Where to buy: You can purchase CDs through your bank or credit union.

12. High-Yield Savings Accounts

High-yield savings accounts differ from traditional savings accounts because they pay out a much higher annual percentage yield (APY). While high-yield savings accounts have a higher interest rate, the payout is generally higher as well.

Through high-yield savings accounts, investors also get the stability of a federally insured account.

Best for: High-yield savings accounts are best for investors looking for quick wins on small investments. High-yield savings accounts tend to have a low minimum deposit or no minimum at all.

Risks: High-yield savings accounts typically don’t pay enough interest to keep pace with inflation. As a result, they may not be helpful in saving for long-term goals like retirement.

Rewards: High-yield savings accounts are FDIC-insured, meaning deposits up to $250,000 are protected in the event of bank failure.

Where to buy: Online banks and traditional banks with multiple branches offer high-yield savings accounts.

13. Roth IRA

When it comes to retirement funds, Roth IRAs are perhaps the best option out there. Like a traditional IRA, a Roth IRA allows you to grow your retirement savings over a long period of time. The difference between a traditional and Roth IRA is that, with a Roth IRA, you can withdraw your funds tax-free when you’re ready to retire.

Best for: Roth IRAs are beneficial for anyone starting to save for retirement. Whenever you start to save, you should certainly consider using a Roth IRA.

Risks: Withdrawing from your Roth IRA before your retirement will result in a 10 percent penalty on earnings.

Rewards: A Roth IRA allows you to invest in stocks and stock funds tax-free. While they may not always yield returns, the payout will be higher when they do.

Where to buy: You can open a Roth IRA through any brokerage firm or at a bank.

14. Fixed Annuities

Fixed annuities allow you to pay a set amount and get guaranteed compensation as a result. Fixed annuities have fixed interest rates and a fixed rate of return, meaning you know how much income you’ll receive. Because of this predictability, fixed annuities are one of the most low-risk investments, as income doesn’t depend on how the market moves.

Best for: Fixed annuities are a good investment for people in or nearing retirement. This consistent stream of income ensures investment stability after you retire.

Risks: You can’t access your money before the maturity date of your annuity. If you do need to access your money, you may incur a penalty fee.

Rewards: Zero market volatility. With a fixed annuity, you can be sure you’re receiving income regularly.

Where to buy: You can buy fixed annuities through a brokerage firm.

15. Money Market Mutual Funds

Money market mutual funds tend to be one of the lowest-risk investments. These are a type of fixed income mutual fund that invests in debt securities with little to no credit risk.

These investments are generally safer because the debt securities they hold are required to follow regulatory retirements, meaning they have to reach a certain standard of quality, liquidity, and maturity.

Best for: Money market mutual funds lend themselves to low-risk investors looking for quick cash. Compensation isn’t as high as other investments, but risk and volatility are much lower.

Risks: Money market funds aren’t government-issued, so if your bank goes bankrupt, you’ll likely lose your investment.

Rewards: Due to low volatility and little risk, you’re very likely to see positive yields.

Where to buy: You can invest in money market mutual funds through brokerage companies or mutual fund firms.

What To Consider Before You Invest

Deciding what to invest in depends on a variety of factors, most of which are specific to you, your financial situation, and external market conditions. Here are some factors to consider before investing.

Risk Tolerance

In investing, risk tolerance refers to how willing you are to risk market volatility. Cryptocurrency, for example, is a particularly volatile market and is usually more attractive to investors with a high-risk tolerance. The S&P 500, on the other hand, is less subject to volatility, making it more appealing to low-risk investors.

This isn’t to say one is better than the other; the two simply lend themselves to different investing styles. High-risk investors may see more significant returns than low-risk investors, but the potential for loss is also much greater.

Budget

Your budget will largely dictate what investments you’re able to make. Investing in real estate, for example, most likely isn’t realistic for beginner investors. However, a lower-budget investment could be a value stock, with the expectation the price of the stock will grow over time.

Large-cap stocks like Berkshire Hathaway and Amazon may be out of reach for some investors as well. Your budget will certainly have a say in which stocks you can buy shares of.

Financial Knowledge

You should also consider your own financial knowledge when investing. Investing in growth stocks, for example, requires a detailed understanding of market trends and what companies are best positioned to thrive in the current market.

The S&P 500, on the other hand, does that part for you. The companies in the index have proven success, and it doesn’t take significant financial knowledge to know that it’d be relatively safe to invest in them.

Time Horizon

Before you make any investments, ask yourself, “When do I need the money?” Some investments yield relatively quick returns. For others, you may not see real compensation for years after you make the investment. Small-cap stocks, for example, bet on the continued growth of a young company. There’s really no telling how long this could take, but in most cases, it’s a longer amount of time.

Value stocks also anticipate changing market valuations of companies. However, you have to commit to being patient with the market to see return on investment.

Liquidity

Liquid assets are earnings that can be easily translated into cash. This is important because liquidity varies in investments. Stocks and bonds are considered investments with the most liquidity because you can sell them at any time.

Real estate, however, is one of the least liquid assets, as it can take a longer time to see returns. When considering your time horizon, also think about how quickly your investment can be converted into cash.

What is the Safest Investment in 2023?

While there is no one-size-fits-all approach to investing, the safest investment for you boils down to weighing your goals, budget, risk tolerance, and how long you’re willing to wait on returns. Having a strategy in place before you invest is essential to seeing the results you desire.

Sourcing

- Investing is a good way to outpace rising inflation. “Investing in the stock market is more important than ever amid rising inflation.” CNBC. (March 2022).

- Cryptocurrency is available through both traditional brokers and online exchanges. The Motley Fool. (September 2021).

- Corporate bonds are near multi-year highs. “4 Reasons to Consider IG Corporate Bonds Now.” Charles Schwab. (August 2022).

- Corporate bonds may yield greater returns than government bonds. “Corporate bonds: Here are the big risks and rewards.” Bankrate. (June 2022).

- Robo-Advisors use modern portfolio theory to offer financial advice. “Modern Portfolio Theory: What MPT Is and How Investors Use It.” Investopedia. (September 2021).

- Robo-Advisors have been criticized for lacking human emotion. “Why robo-advisors are striving toward a ‘hybrid model,’ as the industry passes the $460 billion mark.” CNBC. (April 2021).

- You can create a target-date fund through your 401K plan. “Target-date funds are assets that are designed to offer long-term growth by a set time.” Business Insider. (August 2022).

- CDs pay interest out over a set period of time. “What Is a Certificate of Deposit (CD) and What Can It Do for You?” Investopedia. (May 2022).

- CDs are federally insured. “Are Certificates of Deposit (CDs) FDIC-Insured?” Smartasset. (March 2022).

- Deposits in high-yield savings accounts up to $250,000 are protected in the event of bank failure. “What a high-yield savings account is and how it can grow your money.”CNBC. (September 2022).

The post The 15 Best Investments for 2023 appeared first on MintLife Blog.