President Biden signed an omnibus budget bill in December 2022, which included bipartisan legislation helping to make it easier for people to save for retirement. The SECURE (Setting Every Community Up for Retirement Enhancement) 2.0 Act builds on the previous SECURE Act law, which was passed in 2019. While not all of the changes in

The post 5 Things the SECURE 2.0 Act changes about retirement appeared first on MintLife Blog.

You may already know they can help you come tax time, but what are tax deductions and how are they different from tax credits? Tax deductions lower your taxable income. Tax credits provide you with an overall discount on your tax bill.

Let’s break down exactly what that means so you can optimize your tax refund this year. Plus, learn some of the most common tax breaks you may be eligible for.

- What Are Tax Deductions?

- What Are Tax Credits?

- Why Does the Tax Code Include Deductions?

- How Do Tax Deductions Work?

- 20 Money-Saving Tax Credit and Tax Deduction Examples

What Are Tax Deductions?

Tax deductions allow you to reduce the amount of taxable income you have. This lowers the amount of taxes you need to pay overall. For example, if your adjusted gross income is $80,000 and you file as a single, the federal taxes you owe would be about $13,216 with no deductions. Say you itemize deductions and deduct $10,000 in mortgage interest. Your taxable income becomes $70,000, putting your tax bill at about $11,016.

What Are Tax Credits?

Tax credits offer an overall discount on your tax bill. For example, say you’re a single filer using the same $80,000 adjusted gross income from above, your tax bill would be about $13,216 with no deductions. Say you file using a $10,000 tax credit. Your adjusted tax bill would be $3,216.

In our example, a $10,000 deduction and a $10,000 credit result in two very different tax bills. That’s why it’s important to research what options are available to you, and how they will affect your overall federal tax bill so you can optimize your refund.

| Should I Use a Tax Deduction or Credit? | ||

|---|---|---|

| Tax Deduction | Tax Credit | |

| Adjusted Gross Income | $80,000 | $80,000 |

| Deductions | $10,000 | $0 |

| Taxable Income | $70,000 | $80,000 |

| Initial Taxes Owed | $11,016 | $13,216 |

| Tax Credits | $0 | $10,000 |

| Final Taxes Owed | $11,016 | $3,216 |

Why Does the Tax Code Include Deductions?

The tax code includes deductions to account for lost income, already taxed income, or to promote certain expenditures. For example, taxpayers may deduct money spent on charitable contributions. Allowing this deduction incentivizes donations, which tend to benefit society overall.

How Do Tax Deductions Work?

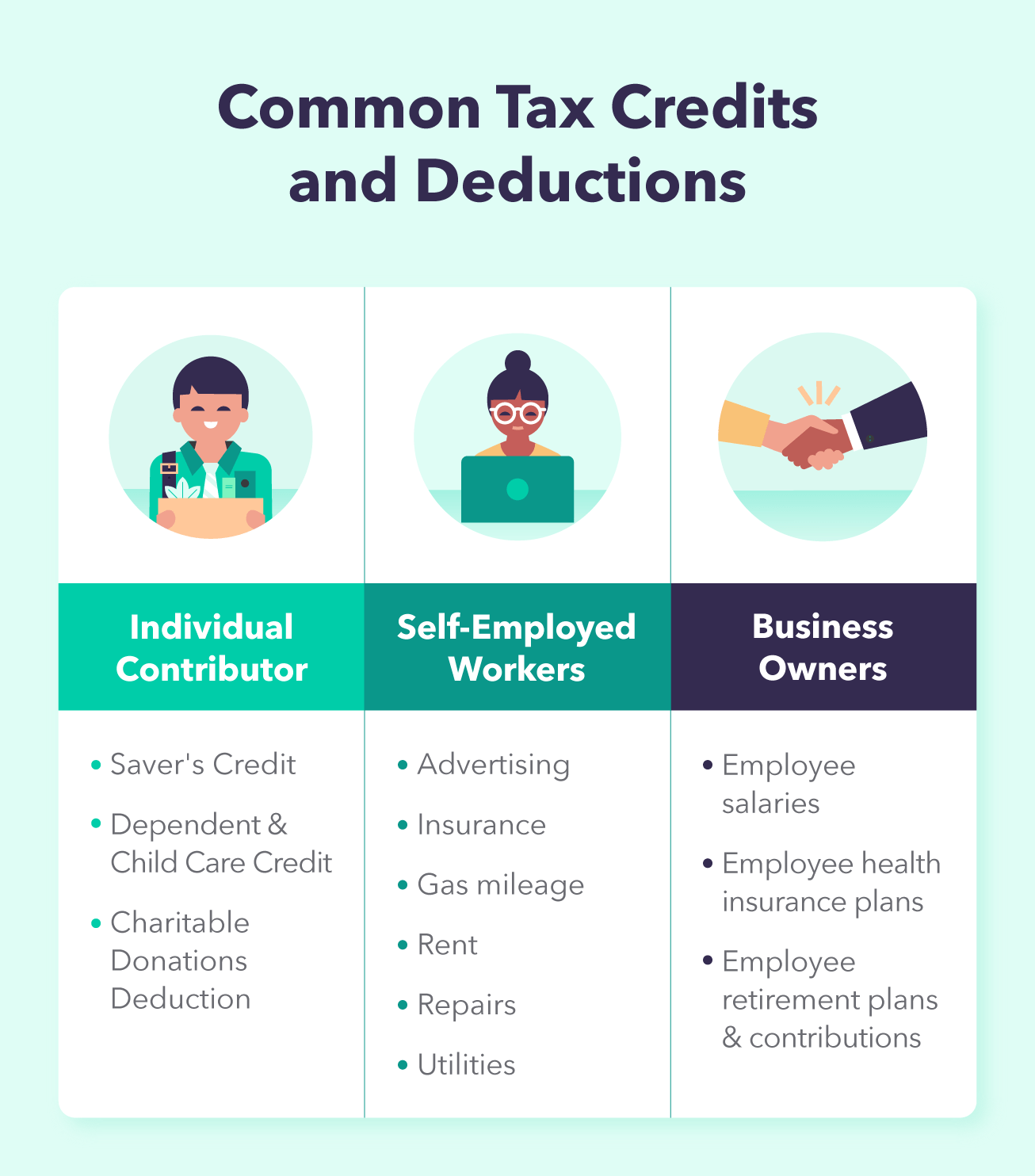

Tax deductions work by lowering taxable income. Here’s how that will look when filing taxes as an individual, self-employed person, or business owner.

Individuals and Tax Deductions

Individuals can either choose to take the standard deduction or itemize deductions when they file their tax return. You cannot do both.

But what are standard tax deductions and itemized deductions anyway?

- Standard deduction: The standard deduction is a flat rate reduction in your taxable income. The IRS sets new rates for each tax year. The 2022 standard deduction rates are as follows:

| 2022 Standard Deduction | |

|---|---|

| Filing Status | Deduction Amount |

| Single | $12,950 |

| Married Filing Jointly | $25,900 |

| Head of Household | $19,400 |

| Married Filing Separately | $12,950 |

- Itemized deductions: Itemized deductions do not take the flat rate standard deduction. Instead, they list all eligible deductions to adjust their taxable income.

After taking deductions, you are left with your taxable income. Taxable income isn’t taxed at a flat rate at the federal level. Instead, it is taxed progressively depending on your tax bracket.

For example, if your taxable income is $70,000 and you are filing singly, you would fall in the 22 percent tax bracket:

| Single Filer (2022) | |

|---|---|

| Tax Rate | Taxable Income Bracket |

| 10% | $0 to $10,275 |

| 12% | $10,276 to $41,775 |

| 22% | $41,776 to $89,075 |

| 24% | $89,076 to $170,050 |

| 32% | $170,051 to $215,950 |

| 35% | $215,951 to $539,900 |

| 37% | $539,901 or more |

In our example, you wouldn’t be taxed 22 percent of $70,000. Instead you would be taxed as follows:

- 10 percent of $10,275, which equals $1,027.50

- 12 percent of $31,499, equal to $3,779.88

- 22 percent of $28,224, which is $6,209.28.

This means the total tax bill would be $11,016.66.

Self-Employed and Tax Deductions

As a self-employed person, you get to take deductions in two steps — first, as you figure out your business’s net income; and second, as an individual would.

As a sole proprietor, independent contractor, or single member LLC, you will report any business profits and expenses on a Schedule C form. Eligible business expenses work like deductions to reduce your taxable income.

So, what are business tax deductions more specifically? They can be costs associated with things such as:

- Advertising

- Insurance

- Legal services

- Professional services

- Inventory

- Rent or a home office

- Repairs

- Utilities

- Continuing education

- Other business expenses

After itemizing your business profits and expenses, you are left with the taxable income from your business. You can then combine this with any other income you may have to find your total taxable income.

Once you have your total taxable income, you file as an individual would — by taking the standard deduction or itemizing. If you choose to itemize, you would not deduct your business expenses again. Here, you would only itemize deductions such as mortgage interest, charitable donations, or state and local income taxes.

Business Owners and Tax Deductions

As an S corporation or C corporation business, you pay taxes similarly to self-employed individuals — by deducting business expenses from your gross income to determine the business’s net income first and then taking any individual deductions.

Business deductions can include any of the expenses a self-employed individual can take, as well as expenses of larger businesses such as:

- Employee salaries

- Employee health insurance plans

- Employee retirement plans and contributions

However, unlike self-employed individuals, S corporations and C corporations must pay estimated taxes quarterly before filing the final return at the end of the tax year. This final return will be Form 1120S for an S corporation or Form 1120 for a C corporation. S corporations will also file a Form K-1 for each shareholder.

20 Money-Saving Tax Credit and Tax Deduction Examples

Now comes the question — what can you write off on taxes? Whether you’re an individual, self-employed worker, or business owner, check out our tax credits and tax deductions list to see what you may qualify for the next time you file.

1. Child and Dependent Care Credit

If you need to pay for childcare in order to work or look for work, you may be eligible for reimbursement through the Child and Dependent Care Credit. It can also help pay for the care of an incapacitated spouse or adult dependent. It’s also fully refundable as of 2021, meaning it can earn you money back even if you don’t owe taxes.

2. Earned Income Tax Credit

This credit seeks to provide a tax break to low- and moderate-income families. It can provide a refund of up to $6,935 depending on your income, marital status, and how many children you have. You must have an adjusted gross income under $57,414 to qualify.

3. Adoption Credit

The adoption credit can provide a refund of up to $15,950 per eligible child. It can be applied to international, domestic private, and public foster care adoptions.

4. Saver’s Credit (Retirement Savings Contribution Credit)

This credit gives a tax break for eligible contributions to your IRA or employer-sponsored retirement plan. It can save you up to $2,000 when filing singly or $4,000 when filing jointly on your tax bill.

5. Residential Energy Efficient Property Credit

This credit provides a tax break for qualifying energy-efficient home upgrades including solar, wind, geothermal, and fuel-cell technology. Depending on when the equipment was installed, you can receive a credit of 22 percent to 30 percent of the cost of the system, including installation.

6. Plug-in Electric Vehicle Drive Credit

The electric vehicle credit can provide a tax break of up to $7,500 for qualifying electric vehicles. It generally only applies to vehicles where final assembly occurred in North America.

7. Lifetime Learning Credit

If you’ve enrolled in undergraduate, graduate, or professional degree programs, the lifetime learning credit may provide you with a refund of up to $2,000 come tax time.

8. American Opportunity Credit

This credit can refund you up to $2,500 of eligible higher education expenses on your tax bill. Eligible expenses include tuition, books, and school fees — but not living expenses or transportation.

9. Business Vehicle Deductions

If you are self-employed or own a business, you can deduct 58.5 cents per mile you drove during business operations. Be sure to keep a log of all driven miles in the event of an audit.

10. Home Office Deductions

Qualifying self-employed, contracted, or gig economy workers who regularly use part of their home for business can deduct rent, utility, and other associated costs from their taxable income.

11. Business Expenses Deductions

Self-employed individuals or business owners can deduct all business expenses when reporting business income. This includes any money spent on business rent, advertising, insurance, professional services, inventory, repairs, utilities, continuing education, wages, contributions to employee retirement accounts, or other business expenses.

12. Student Loan Interest Deduction

If you paid interest on your student loans, you may be eligible to deduct up to $2,500 from your taxable income.

13. Charitable Contribution Deduction

You can deduct eligible charitable contributions from your taxable income — up to 100 percent of your adjusted gross income as an individual, although some limitations apply. Eligible donations can be cash or physical, like clothing.

14. Medical Expenses Deduction

You can deduct qualifying medical or dental expenses that amounted to more than 7.5 percent of your adjusted gross income from your taxable income.

15. Mortgage Interest Deduction

You can potentially write off interest paid on up to $1 million of mortgage debt. If you entered the mortgage after December 15, 2017, this number goes down to $750,000 ($375,000 if married filing separately).

16. Gambling Loss Deduction

Gambling losses are deductible, but only in relationship to winnings. For example, if you won $8,000 but lost $5,000, you can deduct the $5,000 loss for total taxable earnings of $3,000. However, you cannot deduct more than you win. So if you win $8,000 but lose $9,000, you can only deduct $8,000.

17. Educator Expenses Deduction

School teachers and other eligible educators can deduct up to $300 from their taxable income for money spent on classroom or educational supplies.

18. Health Savings Account (HSA) Contribution Deduction

You can deduct eligible contributions to HSA accounts from your taxable income. For individuals on a high-deductible plan, the limit for eligible contributions is $3,650. For families, this limit moves to $7,300.

19. IRA Contributions Deduction

Depending on your income and whether you or your spouse have an employer-sponsored retirement plan, you may be able to deduct contributions to a traditional IRA. Contributions are fully deductible if you (or your spouse, if applicable) aren’t covered by an employer retirement plan.

20. Early CD Withdrawal Penalties Deduction

If you withdrew money from your certificate of deposit (CD) savings account early and paid a penalty, you can deduct the penalty amount from your federal taxes.

So what are tax deductions and credits? They are provisions in the tax law that can help you lower your tax bill and save money. Tax deductions reduce your taxable income while tax credits provide an overall discount on your tax bill.

Need help filing your tax return? Mint and Turbo Tax have teamed up to help make tax time easy.

Sourcing

- IRS states 2022 standard deduction rates and tax bracket rates. IRS provides tax inflation adjustments for tax year 2022 (Nov. 2021).

- IRS list of tax credits and deductions. Credits and Deductions (Feb. 2022).

- Child and dependent care credit. Topic No. 602 Child and Dependent Care Credit (Oct. 2022)

- Tax inflation adjustments for tax year 2023. IRS provides tax inflation adjustments for tax year 2023 (Oct. 2022).

- Energy tax credit. Energy Tax Credit: Which Home Improvements Qualify? (December 2022).

- Charitable contributions deduction. Charitable Contribution Deductions (Aug. 2022).

- Medical tax deduction. Topic No. 502 Medical and Dental Expenses (Oct. 2022).

- HSA contribution deduction. Publication 969 (2021), Health Savings Accounts and Other Tax-Favored Health Plans (Feb. 2022).

The post What Are Tax Deductions and Credits? 20 Ways To Save on Taxes appeared first on MintLife Blog.